Lawyer explains what makes purchasing property abroad illegal and what is the legal way to go about it.

Dubai, one of the seven emirates comprising the United Arab Emirates, has become a popular destination for tourists and investment over the last few decades. Over time, the emirate has carefully crafted an image of opulence and luxury, while marketing itself as a “world-class business hub”.

So, it wasn’t surprising that Dubai was trending on social media over the past few days. This time, however, it was not for the glitz and bling.

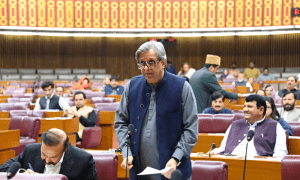

On May 14, an extraordinary volume of leaked property data from Dubai, including over 23,000 properties listed as belonging to Pakistani nationals, was made public. These include political figures, former military men, bankers and bureaucrats.

The leaked data, titled ‘Dubai Unlocked’, provided a detailed overview of hundreds of thousands of properties in the emirate and information about their ownership or usage, largely from 2020 and 2022. It was obtained by the Center for Advanced Defence Studies (C4ADS), a non-profit organisation based in Washington, DC, that researches international crime and conflict.

It was then shared with a Norwegian financial outlet E24 and the Organised Crime and Corruption Reporting Project (OCCRP), which coordinated an investigative project with media outlets from around the world, including Dawn.

The properties owned by Pakistanis range from studio apartments and commercial properties to entire buildings and six-bedroom villas in some of Dubai’s most expensive districts, including Dubai Marina, Emirates Hills, Business Bay, Palm Jumeirah and Al Barsha.

While the leaked data is not evidence in itself of financial crime or tax fraud, it does paint a contradicting picture. The fact that Pakistan, a country running from pillar to post, desperately seeking help from global lenders and other countries, features prominently in the data.

But as these discussions continue, one can’t help but ask questions. Dawn.com asked lawyer Ali Javed Darugar, a tax expert, to explain what the data meant and its legal implications. Here’s what he had to say:

If possessing property abroad is legal — which it is — in what circumstances does it become illegal?

Possessing property abroad is legal. Any illegality associated with owning property abroad may stem from three issues:

(i) If the money to purchase an asset abroad was sent through a not-so-legal channel — through hawala, hundi or any other illegal source.

(ii) If the money was sent abroad legally, but the person failed to declare the asset/property to the Federal Board of Revenue (FBR), and in essence, failed to pay applicable taxes on it.

(iii) Whether the money used for the property is not the proceeds of corruption. So if someone is found guilty of graft, that means the property purchased abroad during the period of said graft becomes illegal.

What is the procedure to follow, as per Pakistani law, if one wants to purchase property abroad?

The money that is sent abroad for the purchase of the property should be done so in compliance with Pakistan’s capital control laws.

These laws prohibit sending money to a person residing in another country without special or general permission exemptions, which allow the remittance of funds abroad. Banks too are barred from remitting any money, that is not generally or specifically approved by the State Bank of Pakistan (SBP), abroad.

Taking huge amounts of money abroad without the permission of the central bank is strictly prohibited.

Therefore, it is quite possible that any money remitted abroad for the purchase of properties by any citizen of Pakistan was made through illegal means.

Moreover, property purchased by a Pakistani abroad should be declared in their tax returns and the applicable taxes must be paid.

It is also obligatory to pay any applicable tax linked to the assets abroad. The calculation of the relevant tax is broadly based on the provision of any double tax treaty that has been executed between the country where such asset is located and Pakistan, and the difference in the applicable tax rate between such country and Pakistan.

Following the Dubai Leaks, what actions should the FBR take?

The FBR should examine the wealth statements of Pakistani citizens/residents who have properties abroad as per Dubai Leaks and verify whether such properties have been declared and whether any applicable tax has been paid.

The statement can also be used to verify whether the owners had any disclosed wealth that could account for the purchase of the asset at the price divulged in the Dubai Leaks. If the price of the asset and its purchase cannot be reconciled with the tax return of the owner, then the FBR has the power to amend the owner’s tax return and impose taxes with respect to any undisclosed income (which was used to buy the property) along with default surcharge and penalty.

How can it be determined whether those named in the leaks are guilty of corruption?

This would be an uphill task keeping in view the requirements of due process. Their tax returns — specifically the wealth statements — should be examined to see if

(i) such properties have been declared, or

(ii) if their income/existing assets show that they can purchase property abroad at the price they did.

If not, this would raise the question of where they got the money to purchase such assets.

The regime prescribed under the National Accountability Bureau generally puts the onus of proving a legal money trail on the accused. However, there has been legitimate criticism of the NAB law that it puts the onus of proving innocence on the accused in contravention of the well-established principle of justice that a person is innocent until proven guilty.

It also needs to be kept in mind that a lot of Pakistanis do not declare their complete assets in their tax returns as a tax evasion mechanism. Tax evasion is illegal but does not in itself prove that the money was obtained through corruption.

Therefore, instead of just focusing on proving corruption, it may be a more expedient strategy to see if the names that have come forth in the leaks comply with Pakistan’s tax laws and capital control laws. Proven contravention of tax laws and capital control laws can also result in imprisonment.

What would these leaks mean for investment in Dubai?

Investment may be negatively affected for such investors who use Dubai as a ‘safe haven’ for money/assets that they have not declared in their home jurisdictions.