[ad_1]

• Slowdown driven by falling commodity prices, stable rupee, high-base effect

• CPI stands at 9.3pc in urban areas, 3.6pc in rural regions

• PM Shehbaz hails downward trend as major achievement for govt

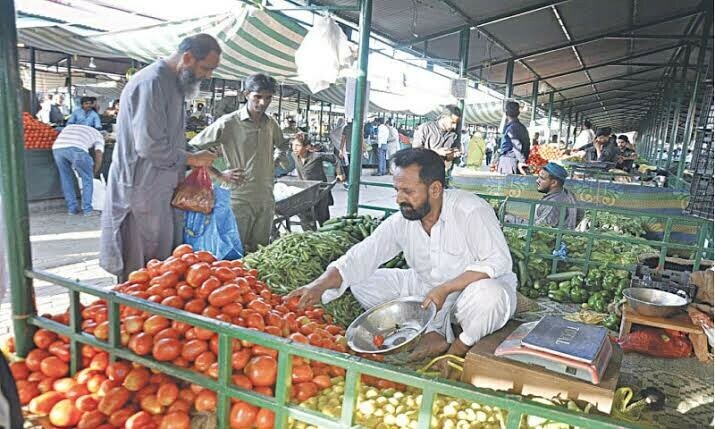

ISLAMABAD: The annual consumer inflation plunged to a 44-month low of 6.9 per cent in September, owing to a steady decline in global commodity prices, an increase in domestic agricultural production and a stable currency rate.

The headline inflation, measured by the Consumer Price Index (CPI), had slowed the previous month to 9.6pc, the first single-digit reading in more than three years, data released by the Pakistan Bureau of Statistics showed on Tuesday.

The monthly consumer price index in September stood at -0.5pc, reflecting that the overall prices dropped compared to the previous month.

The decline in inflation is partly attributed to a high-base effect from last year when annual inflation stood at 31.4pc. However, Prime Minister Shehbaz Sharif and key cabinet members credited the government’s economic reforms. “This is the result of the government’s hard work and economic policies,” he said, adding that the inflation drop proved the economy was stabilising.

The annual CPI inflation has historically been driven by the food and energy sectors. Improved crop yields, particularly of wheat, rice and sugar, helped reduce food prices this year, alongside a lower reliance on imports. The government’s support for agriculture, including increased loans, and favourable weather played a crucial role in boosting production.

Inflation crossed 10pc in November 2021 and then remained in double digits for 33 consecutive months until July 2024. In between, it peaked at 38pc in May 2023.

In the first quarter of the current fiscal year (July to September), inflation averaged 9.19pc compared to 29.04pc during the same period last year. Analysts attribute this decline to a combination of factors, including lower global commodity prices, stable exchange rates and better agricultural outputs.

Mohammed Sohail, CEO of Topline Securities, highlighted aggressive monetary tightening as a key factor. The State Bank of Pakistan (SBP) “has achieved bringing inflation below 7pc one year ahead of target”, he said.

The SBP gradually raised its policy rate from 7pc in August 2021 to a peak of 22pc by April 2023, in an effort to curb inflation. Since then, the rate has been lowered to 17.5pc as inflation began to ease.

Younus Dagha, chairman of the Policy Research and Advisory Council, cautioned that inflation continued to rise despite consecutive rate hikes. This raises questions about the effectiveness of the SBP’s traditional monetary tools, he said, urging a closer examination of the factors behind the recent drop in inflation.

Indices for groups

Of the 12 groups of commodities and services included in the CPI, the most significant impact was probably due to the “Food and Non-Alcoholic Beverages” head, which holds 34.6pc weight in the basket. The index for this group was down 0.59pc year-on-year, thanks to a 3.5pc drop in the prices of non-perishable food items.

The index for the second-biggest group — “Housing, Water, Electricity, Gas and Fuels”, which has a weight of 23.6pc in the CPI basket — was up 20.9pc in September, a slight decrease from 22.2pc in the previous month.

The biggest drop of 7.3pc was seen in the “Transport” group, which holds a weight of 5.9pc in the basket.

Urban vs rural inflation

Urban inflation in September stood at 9.3pc year-on-year, down from 11.7pc in August, with a month-on-month drop of 0.5pc. In rural areas, inflation was significantly lower, at 3.6pc year-on-year, also with a month-on-month decline of 0.5pc.

Food inflation in urban areas dropped to 1.7pc, while rural food inflation saw a slight decrease of 0.9pc. Core inflation, which excludes volatile food and energy prices, was recorded at 9.3pc in urban areas and 12.1pc in rural areas.

In urban areas, the items whose prices increased the most year-on-year included onions (78pc), pulse gram (56.98pc), besan (47.53pc), fish (29.85pc), fresh vegetables (29.17pc), milk powder (21.1pc), chicken (21.08pc), dry fruits (20.98pc), meat (20.92pc), gram whole (17.69pc), pulse moong (16.42pc), fresh fruits (15.19pc), beans (14.97pc), honey (9.15pc), beverages (8.99pc), butter (8.41pc), fresh milk (8.19pc), milk products (8.18pc), and potatoes (7.95pc).

In contrast, the items whose prices dropped were wheat (38.87pc), wheat flour (37.23pc), sugar (14.56pc), cooking oil (11.85pc), gur (10.59pc), wheat products (9.55pc), pulse masoor (7.39pc), mustard oil (6.96pc), rice (6.72pc), vegetable ghee (6.11pc), tea (2.01pc), bakery and confectionery (1.06pc), and dessert preparation (0.19pc).

‘Hard work’

PM Shehbaz hailed the downward trend as a major achievement for his government. “This is because of the hard work of the government’s economic and financial team. The dropping of the inflation rate to 6.9pc was proof of the government’s efforts for a stable economy,” he said in a statement.

He noted that reduced interest rates would also boost commercial activity, benefiting the average citizen. Besides, consumers are benefiting from regular drops in the price of petroleum products, he added.

The premier said that helping the common people has been the government’s top focus.

He stated that there were elements in the country that wanted the country to default on its loan payments, but their plans were unsuccessful.

Information Minister Attaullah Tarar pointed out that foreign exchange reserves had improved, the currency remained stable and inflation was on a downward trend. He also criticised the opposition’s alleged efforts to destabilise the economy.

Published in Dawn, October 2nd, 2024

[ad_2]

Source link