[ad_1]

KARACHI: Shrugging off geopolitical tensions following the Iranian missile attack on Israel, the stock market extended an overnight rally on Wednesday, supported by growing expectations of another policy rate cut despite unending aggressive selling by foreign investors on rising political tensions.

Standard and Poor’s Global Marketing Intelligence forecast multiple cuts in the State Bank of Pakistan’s policy rate in the current fiscal year on receding inflation, which hit a 44-month low of 6.9pc in September. It projected another 200bps cut before the end of December. However, it predicted that the average inflation would remain in double digits thanks to the IMF-driven taxation measures and costly energy prices pushing up the cost of production.

Ahsan Mehanti of Arif Habib Corporation said the S&P projection of a fourth straight rate cut of 200bps, a rise in petroleum sales in September and a surge in global oil prices amid growing tensions in the Middle East also contributed to the bullish close.

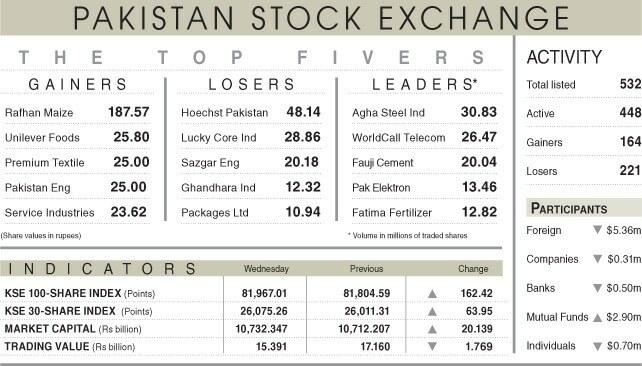

Topline Securities Ltd said the benchmark KSE-100 index closed at 81,967, up 162.41 points or 0.20pc. The session saw significant volatility, peaking at 82,360 and dipping to 81,529, mainly due to geopolitical tensions.

The index was primarily driven by United Bank, Fauji Fertiliser, MCB Bank, Engro Corporation, and Pakgen Power Ltd, which together contributed 270 points.

Trading activity was strong, with 360 million shares changing hands, totalling Rs15.3 billion. Stocks contributing significantly to the traded volume included Agha Steel Ind (30.83m shares), WorldCall Telecom (26.47m shares), Fauji Cement (20.04m shares), Pak Elektron (13.46m shares) and Fatima Fertiliser (12.82m shares).

The shares registering the most significant increases in their prices in absolute terms were Rafhan Maize (Rs187.57), Unilever Foods (Rs25.80), Premium Textile (Rs25.00), Pakistan Engineerings Ltd (Rs25.00) and Service Industries (Rs23.62).

The companies that suffered major losses in their share prices in absolute terms were Hoechst Pakistan (Rs48.14), Lucky Core Industries (Rs28.86), Sazgar Engineering Works Ltd (Rs20.18), Ghandhara Industries (Rs12.32) and Packages Ltd (Rs10.94).

Foreign investors remained net sellers as they offloaded shares worth $5.36m. However, mutual funds extended their overnight buying spree and picked shares worth $2.90m.

Published in Dawn, October 3rd, 2024

[ad_2]

Source link