[ad_1]

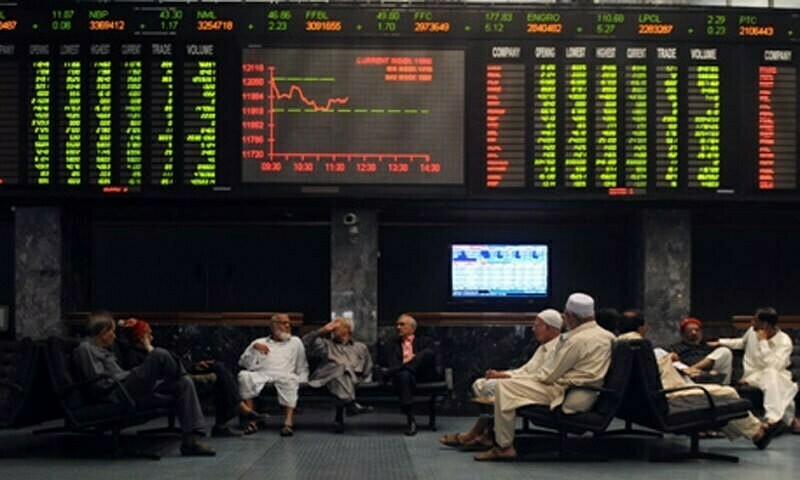

KARACHI: Amid escalating regional tensions following an Iranian missile attack on Israel and mounting political tensions due to ongoing protest by the opposition party in the capital, the Pakistan Stock Exchange (PSX) closed the tumultuous week at a record high of above 83,500.

The bullish spell was driven by surging exports, foreign exchange reserves and growing expectations of another 200 basis points cut in the policy rate in the next review due early November.

However, despite a positive economic outlook, the foreigners continued aggressive selling in the outgoing week, mainly on growing concerns about peace prospects due to the widening Middle East conflict amid fears of a retaliatory attack by Israel on Iranian nuclear sites, which may destabilise the whole region.

The trade and industry leadership, notably the Federation of Pakistan Chambers of Commerce and Industry, renewed the call for a drastic cut in the State Bank of Pakistan’s policy rate immediately to revive industrial and commercial activities since the Consumer Price Index-based inflation receded to a 44-month low creating an ample room for the Monetary Policy Committee to bring it to single digits.

In its market commentary, Arif Habib Ltd (AHL) maintained that the upward trajectory was supported by several significant economic developments, including inflation declining to 6.9 per cent in September, initiation of a buyback of treasury bills worth Rs351 billion at significantly reduced rates, the GDP recorded a growth of 2.52pc in FY24 driven by the agriculture sector.

The trade deficit reached $5.4bn in the 1QFY25, while exports achieved their sixth-highest quarterly figure at $7.9bn, and Rs244bn was raised by SBP via T-bill auction, coupled with 6-month and 12-month T-bill yields declining to the lowest level since April 2022 to 14.4pc and 13.7pc, respectively.

As a result, the benchmark KSE 100 index settled at an all-time high of 83,531.96 points after surging by 2,240 points or 2.76pc week-on-week.

According to AKD Securities Ltd, with the approval of the IMF’s executive board and the subsequent receipt of the first tranche of $1.02bn, the market will maintain a bullish spell next week. Additionally, easing inflation and ongoing monetary policy will likely keep equities in focus, with the market trading at an attractive price-to-earnings ratio of 3.6x.

Published in Dawn, October 6th, 2024

[ad_2]

Source link