[ad_1]

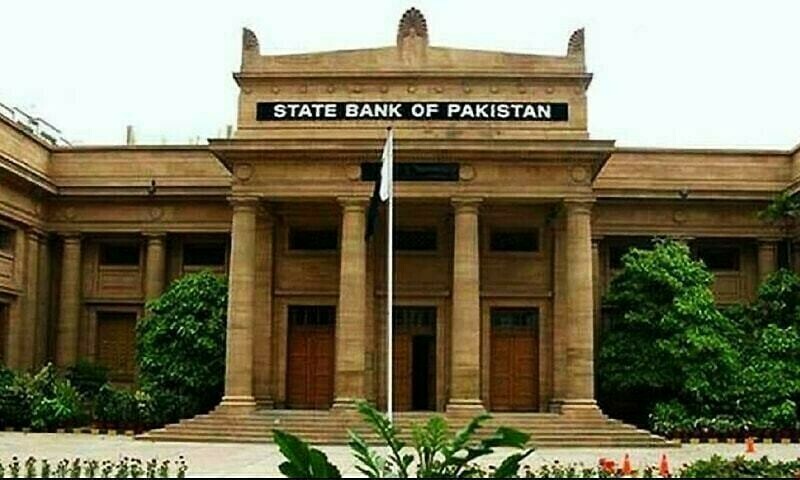

The State Bank of Pakistan’s (SBP) Monetary Policy Committee (MPC) Meeting is set to convene today to decide on the country’s monetary policy, including the key interest rate, amid demands for a major rate cut.

The SBP will issue the Monetary Policy Statement through a press release on the same day, a statement by central bank said.

The policy is of great interest to the stakeholders of the economy as a significant cut in the interest rate is expected.

Most analysts believe that central bank will reduce its policy rate by 200 basis points in its upcoming meeting, marking the fourth consecutive cut since June, thanks to a decline in inflation, a low current account deficit and higher remittances.

Inflation numbers for October clocked in 7.2pc. The headline inflation, measured by the Consumer Price Index (CPI), had slowed to 9.6pc in August, the first single-digit reading in more than three years.

Inflation crossed 10pc in November 2021 and then remained in double digits for 33 consecutive months until July 2024. In between, it peaked at 38pc in May 2023.

To counter inflationary pressure, the SBP had gradually raised its policy rate from 7pc in August 2021 to a peak of 22pc by April 2023, in an effort to curb inflation. Since then, the rate has been lowered to 17.5pc as inflation began to ease.

In a survey conducted by Topline Securities, the brokerage firm noted that 85 per cent of market participants expected that the central bank would announce a minimum rate cut of 200 basis points.

“We believe that the larger rate cut expectations in the upcoming monetary policy meetings are driven by the single-digit inflation reading of 6.9pc in Sept 2024,” the firm said.

Consequently, it believed that SBP will continue to keep a positive real rate in the range of 300 to 400 bps in medium term in order to absorb any external and budgetary shock.

[ad_2]

Source link