[ad_1]

KARACHI: Despite a negative opening, the stock market on Tuesday maintained its record-setting spree for the second straight day as a bigger-than-expected cut in the interest rate bolstered investor sentiments, helping the KSE 100 index close above 92,000 for the first time.

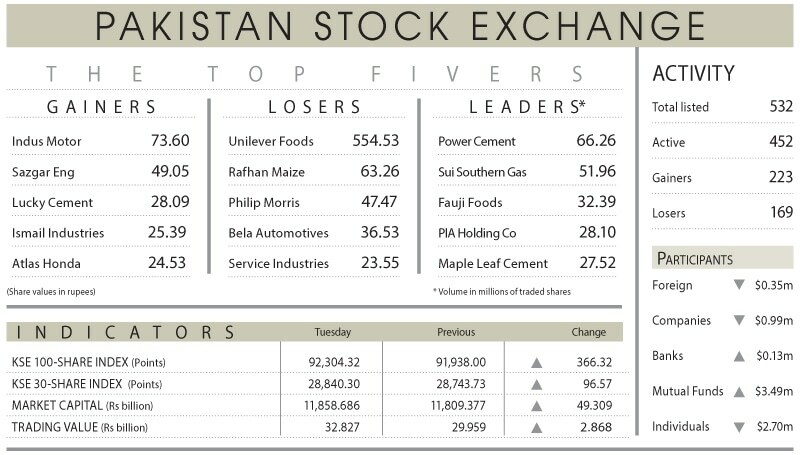

The KSE-100 index hit an intraday low of 91,536.09, losing 401.91 points and a high of 92,514.30, gaining 576.30. However, the index settled at the highest-ever level at 92,304.32 after adding 366.32 points or 0.40 per cent day-on-day.

Ahsan Mehanti of Arif Habib Corporation said stocks settled at an all-time high due to robust remittances in October, surging the $3 billion mark and a surprising reduction of 250bps in the State Bank of Pakistan’s policy rate against the market consensus expectations of 200bps.

Other factors that helped the market maintain its bull run include surging cement exports by over 50pc year-on-year in October, an expected inflow of $500 million from the Asian Development Bank this week, and higher global crude oil prices, he added.

Topline Securities Ltd said the positive trend could be attributed to a fourth consecutive interest rate cut, bringing the policy rate to 15pc from 22pc in June.

Also, assurances from the SBP chief about key economic indicators boosted investor confidence.

Key contributors to the index rise were Lucky Cement, Hub Power, Oil and Gas Development Company, Systems Ltd, and Millat Tractor, which collectively added 274 points. Conversely, Unite Bank Ltd, Habib Bank, Bank Al-Habib, Cherat Cement, and Meezan Bank wiped out 143 points from the index.

However, investor participation witnessed a surge as the trading volume rose 27.66pc to 752.66m shares while its value increased 9.57pc to Rs32.82 day-on-day.

Stocks contributing significantly to the traded volume included Power Cement (66.26m shares), Sui Southern Gas (51.96m shares), Fauji Foods (32.39m shares), PIA Holding Co (28.10m shares) and Maple Leaf Cement (27.52m shares).

The shares registering the most significant increases in their prices in absolute terms were Indus Motor (Rs73.60), Sazgar Engineering Works Ltd (Rs49.05), Lucky Cement (Rs28.09), Ismail Industries (Rs25.39) and Atlas Honda (Rs24.53).

The companies that suffered significant losses in their share prices in absolute terms were Unilever Foods (Rs554.53), Rafhan Maize (Rs63.26), Philip Morris (Rs47.47), Bela Automotives (Rs36.53) and Service Industries (Rs23.55).

Foreigners remained net sellers as they sold shares worth $0.35m. However, mutual funds remained active buyers and picked shares worth $3.49m.

Published in Dawn, November 6th, 2024

[ad_2]

Source link